Credit Card Eligibility Checker

How to check if you're eligible for a credit card

Check if you're eligible with no impact to your credit score

Check if you're eligible with no impact to your credit score Complete our short application form and get a decision in just 10 seconds

Complete our short application form and get a decision in just 10 seconds From poor to excellent, any credit score considered

From poor to excellent, any credit score considered48.9% APR Representative (variable)

Subject to affordability

For all credit scores

For all credit scores

Check eligibility with no credit score impact

Check eligibility with no credit score impact

When you apply for a credit card directly with a provider, they will carry out a hard search credit check as part of the application process. This will leave a mark on your credit file. Too many hard searches over a short period of time could have a negative effect on your credit score.

Did you know that you can check your eligibility for a credit card before you apply, with no impact to your credit score?

Here, we bring you our guide to the credit card eligibility checker.

What is a credit card eligibility checker?

A credit card eligibility checker gives you an idea of how likely you are to be approved for a credit card before you make a full application.

If you are eligible for a credit card, it’s important to remember that this doesn’t guarantee you’ll be approved by the credit card provider.

Your credit card eligibility

Your credit card eligibility depends on several factors, including:

Your personal details. You’ll need to be over 18 and a UK resident with a UK bank account and valid debit card, and not legally restricted from obtaining credit.

Your affordability. Lenders will take a closer look at your employment status, income, and regular outgoings to understand your financial situation. They will need to be sure you’re able to repay what you borrow.

Your credit history. If you’ve borrowed in the past, lenders will look to see how well you’ve managed any previous credit commitments.

Your credit score. A low credit score or non-existent credit history could mean that your borrowing opportunities are more limited than someone with a good credit score, but there might be options for those with bad credit.

Why is it a good idea to use a credit card eligibility checker before applying?

Checking your chances of approval with a UK eligibility check before you apply for a credit card could help protect your credit score.

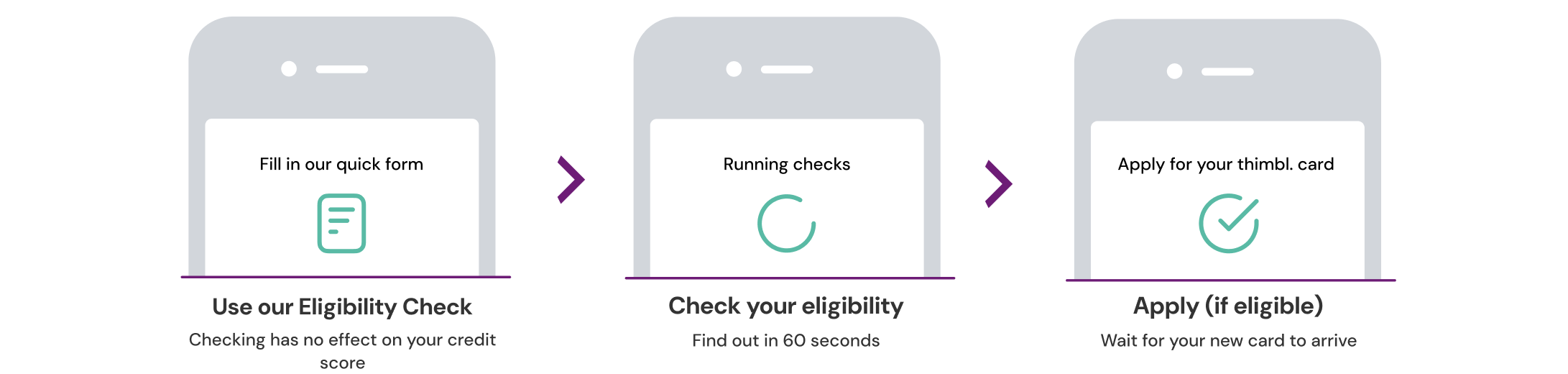

How to check your eligibility with thimbl

Find out if you could be eligible for a thimbl Credit Card in just 60 seconds

Who can check their eligibility for a thimbl Credit Card?

You’re welcome to check your eligibility for a thimbl Credit Card if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account with a valid debit card;

- Have a regular income paid directly into your bank account; and

- Have no restrictions on applying for credit, including bankruptcy.

I have bad credit; can I still check my eligibility for a credit card?

Yes, you can.

From less-than-perfect to excellent, whatever your credit score you can use a credit card eligibility checker.

Will checking my eligibility affect my credit score?

Don’t worry – using an eligibility checker will not impact your credit score.

An eligibility check uses soft search technology which won’t leave a mark on your credit file.

A soft search will only be visible to you and the company who carried out the check.

If you were pre-approved for a credit card and decide to make a full application, you will need to complete further checks with the provider, including an affordability check and a hard search.

Before accepting a credit card, you should carefully consider whether it is the right product for you. Falling behind on your repayments may result in late fees, additional charges, and a decline in your credit score.

You should also be aware of the potential impact of mismanaging a credit card, including how one might affect any future mortgage applications if you have defaulted on your repayments.

What details will I need to provide as part of a UK eligibility check?

To complete the thimbl Express Check eligibility checker, you will be asked to provide the following information:

- Your personal information, including your full name, email address, and date of birth;

- Your address. If you have lived at your address for less than three years you’ll also be asked for your previous address details.

- Your employment status and monthly income; and

- Your essential monthly outgoings, such as mortgage or rent and bills.

What happens next?

If the eligibility check shows you have been pre-approved for a credit card, you’ll be redirected to our partner Zable where you will complete a full application. You’ll be asked for some further details, and possibly a recent payslip, proof of identity, or proof of address.

Zable will then run a hard credit search.

If Zable approve your application, you’ll be sent the terms and conditions for your new credit card. Read these carefully to be certain that the card is the right one for you and your circumstances.

You can expect to welcome your new credit card to your wallet in around 7-10 working days. Your PIN will be sent separately.

You get all this with thimbl

Tap and go - Quick and easy contactless payments up to £100.

Secure banking app - Manage your credit card online, wherever and whenever you like, with the free mobile app.

A trusted service – Over 4,500 positive reviews from our customers and we are partnered with Zable.

Page last reviewed: 18th February 2025

Page reviewed by: Harry Lawrance

You get all this with thimbl

Tap and go

Quick and easy contactless payments up to £100.

Secure banking app

Manage your credit card online, wherever and whenever you like, with the free mobile app.

A trusted service

Over 4,500 positive reviews from our customers.

48.9% APR Representative (variable)

Quick links

Worried about money?

If you're worried about the cost of living, need support with budgeting, or think you might need debt advice, StepChange could help. They offer free and impartial support and help hundreds of thousands of people every year to deal with their debts and take control of their finances.

To find out how StepChange could help you, take the free Money Health Check. It's quick and easy to complete, and will give you a personalised recommendation on what to do next.

Meet the team

Head of Compliance

Head of Partnerships

Managing Director, thimbl

Marketing Manager, thimbl

Financial Content Writer

Frequently asked

questions

If you've got a question, you may just find the answer you're looking for here. If not, please visit our contact us page and get in touch.

How do credit cards work?

- Use your credit card to make a purchase. Credit cards are widely accepted both online and in shops, restaurants, and other services - look for the Mastercard logo before making a purchase. You can also use your thimbl card anywhere that accepts Apple or Google Pay.

- Your credit card will come with a credit limit. It’s important not to spend over this amount as this will come with an overlimit fee.

- Pay at least the minimum repayment due on your balance each month. Be sure to make your payments on time – not doing so could result in additional fees and affect your credit score.

- Your balance will be charged interest. Your interest rate will be explained to you in your terms and conditions.

- If you pay your credit card balance in full before your statement is produced each month, you won’t pay any interest.

- Your activity will be fed back to the credit bureaus. Consistently keeping on top of your repayments may mean that you see an improvement to your credit score.

How can I improve my credit score?

- Register to vote. This will link you to your current address and make it easier for potential lenders and brokers to identify you should you apply for credit in the future.

- Check your credit report for errors and report any mistakes as soon as possible.

- Pay your bills and any current credit accounts on time each month.

- If you have an existing credit card, be sure to stay within your credit limit and avoid going overlimit.

- If you’re looking for a new credit card, you might want to look into a credit builder credit card, like thimbl’s own. When used responsibly alongside other credit building methods, you could, in time, see an improvement in your credit score. You can check to see if you are likely to be approved for a credit card using an eligibility checker.

I’m worried about money – is there anything I can do?

We work closely with:

MoneyHelper – 0800 138 7777* or www.moneyhelper.org.uk

National Debtline – 0808 808 4000* or www.nationaldebtline.org

StepChange Debt Charity – 0800 138 1111* or www.stepchange.org

Did you find this article helpful?

Let us know how we can be more helpful

Please leave your anonymous feedback to help us keep improving.

Need help or support?

Whether it’s a question or you just need support, we’re here to help.